The pharmaceutical sector in Bangladesh is one of the thrust sectors and plays a vital role for the country’s economy. The sector utilizes highly skilled manpower along with advanced machinery for manufacturing high-quality generic medicines and vaccines for local and international markets at competitive prices. Along with advanced machinery, only the best scientific equipment from places like SciQuip is used for the testing and production of more pharmaceuticals to treat more and more diseases, which is admirable across the globe. Manufacturing on this level means that essential requirements must be met consistently, with the use of GoatThroat Pumps as well as other equipment that can move this process along in a smooth and efficient manner, this sector will be able to continuously flourish.

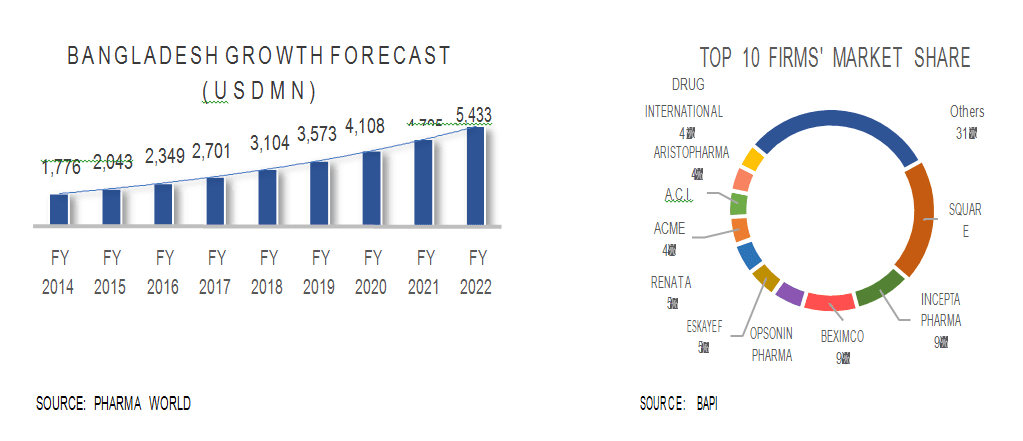

Manufacturers might be consistently having to invest and look for new machinery to deal with processes such as internal logistics and product production. They might look to a publication similar to Link Magazine, for potential solutions, or they might directly go to suppliers to find a solution. These are all considerations manufacturers might be interested in given the expanding market. With a current market size of $1.2 billion, the market is poised to cross $2 billion by 2018. In fact, provided the political situation remains as stable as it has been for the last year, the growth may be even higher than projected.

The Balancing Act Between Global and Domestic Markets

According to IMS projections, the global pharmaceutical market will grow to USD 1.135 trillion from USD 953 billion at a compound annual growth rate (CAGR) of 3-6% during 2013-2017.

Led by China, the BRIC countries (Brazil, Russia, India, and China) accounts for almost 70% of all pharmaceutical market sales. Parallel to the global picture, the emerging countries show a positive growth trend, where Bangladesh is one of the Tier 3 pharmerging countries that is forecasted to contribute to this industry growth by 6–9% between 2013–2017.

In the global market, the lion’s share of export is contributed by patented drugs. In the domestic market, however, the inverse is true: 85% of the drugs sold are generics and 15% are patented drugs. The local market comprises of 83 active pharmaceutical companies, out of which top 20 companies control 85% of the market share. The local market size currently rests at USD 1.53 billion, with local manufacturers meeting 97% of the demand.

Modest Growth in Export Sector

As a member of WTO and being enlisted as one of the LDCs, Bangladesh currently enjoys the benefits of intellectual property rights that allows producing generic drugs and exports until 2032 without compulsory licenses or paying the patent holders and thus providing an advantage to the local manufacturers and exporters. This has allowed pharma companies to exports to 107 countries in Europe, Asia, Africa and Latin America with export standing at USD 72 million in 2015.

However, there is still much ground to be covered, in terms of both share of Bangladesh’s total export (0.23%) and share of the global pharmaceutical export market (0.11%).

Growth Incentives

Healthy growth trajectory is boosting the pharmaceutical manufacturers towards R&D for newer generics with global standards in place. The DGDRA Bangladesh is playing the key role in inspecting the WHO, GMP and SOP of the pharmaceutical manufactures and enrolling the certifications for subsequent two years’ validity from the date of inspection.

Furthermore, to meet the staggering local and international demand, the government has extensively imposed lower or zero import duty and VAT for certain raw materials/ items and certain capital machineries, and also allowed tax holidays of four to six years to investors in this sector.

Rapid Growth Poised to Stay

The Bangladeshi pharmaceutical market is growing at a fast pace and has a promising future. According to Business Monitor International’s latest report, Bangladesh has moved one step upward to occupy the 14th position amongst 17 regional markets.

This sector offers an enormous investment opportunity and has the potential to export alongside the RMG sector in terms of value, catering to increasing consumption worldwide.

The Way Forward

Under WTO’s Agreement on Trade Related Aspects of Intellectual Property Rights (TRIPS), 48 LDCs, including Bangladesh, were granted exemption from drug patent fees in producing generic drugs until 2016. Recently, this was extended to 2032.

Although the advantage that can be gained from TRIPS has been much lauded in Bangladesh, in reality not much benefit has been gained due to lack of infrastructure required for producing quality generic drugs cost effectively.

To rectify this, the industry needs to focus on strengthening backward linkages. The government also needs to create an export-friendly environment with activity from both public and private sector stakeholders.

- Localize Pharmaceutical Value Chain to Reduce Costs: One of the highest cost components in medicine production is APIs, which can contribute as much as 40% of the total cost. At the moment, 80% of these APIs are imported from India and China.

Although 15 Bangladesh companies (such as Beximco, Square and Opsonin) are manufacturing active pharmaceutical ingredients (API), this is a very small percentage of the 85 active firms in the market.

Backward integration in APIs is a key issue for the pharma industry’s growth. Currently India, the top generic drug player, has 3500 Drug Master File (DMFs) approval for APIs whereas we have none.

To mitigate this, the government has taken the significant step of constructing an API Industries Park at Munshiganj, 40 km from the capital. About 40 firms are planned to be established at the plant, which will include a central effluent treatment plant incinerator. However, the project, originally scheduled to be completed by 2012, has been repeatedly delayed, with costs rising by 55%. As a result, progress in backward integration regarding APIs has stalled.

Bioequivalence testing, which determines if the generic version is identical to original brand, is another crucial part of the value chain. This is mandatory for product registration in any developed market and is very expensive when conducted abroad in USA or Europe.

A central bioequivalence and drug testing laboratory would help the industry by not only reducing this cost, but also allowing for routine quality checks on locally produced drugs, further strengthening the case for entry into developed markets.

- Greater collaboration between industry and academia: A potent and mature medical academic community is instrumental to fostering a healthy R & D culture in the industry. The government can take cues from its Indian counterpart, which has taken steps to establish specialized pharmaceutical institutes such as the National Institute of Pharmaceutical Education and Research (NIPER).

- More long-term commitment to creating export-friendly environment: In addition to the existing tax holidays and import duty exemptions, the government can also explore other options such as creating Special Economic Zones (SEZs) for the pharma industry to create localized, internationally competitive export environments. SEZs already have a proven track record as SEZs in India and China have significantly boosted pharma exports.

Similar to the way the government is currently supporting the IT industry, it can hold various seminars, conferences and exhibitions to promote the industry. Creating a dedicated seed fund, or even better, a venture capital fund for funding entrepreneurs aspiring to carry out R&D for emerging products such as biologic drugs is also another option that is worth considering. Those conducting sork in the medical and life sciences industries may find it useful to research the benefits that the services of AggregateSpendID could provide them with in their work.

- Engage in Contract Manufacturing with MNCs: Bangladesh’s considerable cost advantages makes it a good candidate for contract manufacturing as MNCs are looking to shift outsourcing operations from previously cost effective regions such as India and China. Already a 60 billion USD business, contract manufacturing has huge potential for Bangladesh.

[spacer color=”1C4A99″ icon=”Select a Icon” style=”1″]

About the Research

All information contained herein is obtained by LightCastle from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well as other factors, however, all information contained herein “As IS” without warranty of any kind.

LightCastle adopts all necessary measures so that the information it uses is of sufficient quality and from sources LightCastle considers to be reliable including, when appropriate, independent third-party sources. However, LightCastle is not an auditor and cannot in every instance independently verify or validate information received in preparing publications.

About LightCastle Partners

LightCastle Partners (LCP) is a business data firm. It works at the intersection of market data and company specifics to simplify decisions and drive business growth. It has served several reputable clients including Mitsubishi, Generac, Asian Capital Advisors, Care Inc., Swiss Contact Katalyst and top tier local corporates among others.